Staying informed

FIND THE SILVER LINING

As the impact of Covid-19 rages on, Global concerns have grown, rattling investors and equity markets around the world. Given the severity of the issue, this article reviews the impact of the coronavirus disruption on wealth and asset management, and comes up with two main themes for reassuring anxious investors:

As the impact of Covid-19 rages on, Global concerns have grown, rattling investors and equity markets around the world. Given the severity of the issue, this article reviews the impact of the coronavirus disruption on wealth and asset management, and comes up with two main themes for reassuring anxious investors:

Maintaining a long-term perspective

Long-term investing is often best separated from short-term economic reactions. Fears of Coronavirus are expected to stabilise in the longer term. Historically, disciplined and experienced investors’ portfolios have benefitted over time due to their measured long-term approach.

Goals-based planning is key

Economic jolts like that of COVID-19 emphasise the power of goals-based planning, which really protects investors from short-term economic crises. Using the goals-based approach, investments are primarily based on the risk capacity aligned to each goal, with lower-risk financial instruments funding near-term goals. As a result, a limited impact is expected on goals-based investments.

DO NOT PANIC

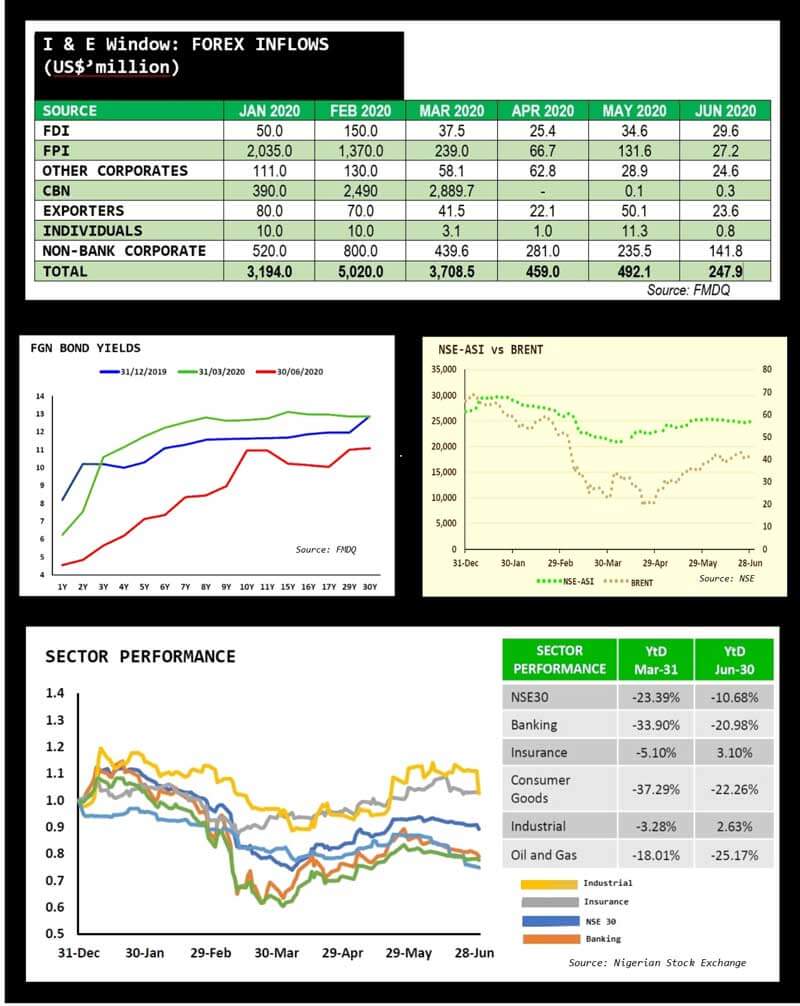

Market performance: Nigeria

The indices signal a bear market. After seeing relentless erosion in the market, you might want to throw in the towel and turn extremely cautious. Avoid rash decisions that lead to panic and exiting an investment half-way. Although bear markets are painful, it usually only takes a few years for the stock market—and even less time for balanced, diversified portfolios—to fully recoup bear market losses. Even in a worst-case “super bear market,” market losses are temporary for investors who are able to stay the course. Following these key pillars will help you safely manoeuvre your finances through this challenging pandemic phase.

Build a financial cushion

Bear markets usually come with crippling economic downturns that destabilise your finances. Before even making moves on your portfolio, build a contingency fund to cover at least six months’ expenses. By building a large cash buffer, investors position themselves to endure financial turmoil – and they are also ready to snap up investments at lower prices. Any money invested in the market should be locked away for long-term goals.

Diversify, diversify — Ensure you are diversified across major asset classes (equities, bonds, cash, and even commodities like gold) and major regions/ sectors. If you truly have a diversified portfolio, some of your holdings should be doing better with the recent market downturn. If everything in your portfolio goes up and down jointly, you are probably not as diversified as you think.

Contribute gradually — Invest a fixed sum regularly into the same investment product over a long-term period. This allows you to buy more units when the cost is low, and less when the price is high. It’s a strategy known as cost averaging.

Take advantage of compound interest — Time in the market is more important than timing the market. Earn interest on the interest you receive by sticking to a disciplined investing plan.

Review your risk tolerance

During good times, we don’t fully realise how much downside we can tolerate. Finding yourself in the middle of a bear market will clearly define your risk appetite. If you are severely uncomfortable now, perhaps you have been taking on more risk than you can realistically handle.

INVESTMENT OPTIONS TODAY

Preserving wealth

Preserving wealth during a downturn starts with minimising capital losses and not reaching for unrealistic returns. Irrespective of your risk appetite or investment goal, Mutual Funds address a wide range of investor needs, and include a mix of traditional equity and fixed income funds, asset allocation, quantitative, global and specialty funds. Some of the preferred options include:

EUROBOND FUND

A Fund targeted at investors who seek medium to long-term capital growth. This is a low risk, open-ended fund invested in Eurobonds floated by the Federal Government of Nigeria, as well as top-tier Nigerian corporates. Subscribers to the Fund enjoy competitive returns on US Dollars. Strategic asset allocation:

- FGN Euro Bonds: 35% – 70%

- Corporate Euro Bonds: 0% – 40%

- FGN Non-USD Sovereign: 0% – 10%

- Short Term Instruments (< 1 year): 5% – 35%

- Cash: 0% – 5%

FIXED INCOME FUND

This vehicle is designed to achieve medium to long term goals. A low-risk open-ended Fund that invests in high quality fixed income securities, which include short term instruments tenored less than one year (Treasury Bills, Commercial Papers, Bank Placements etc.), and FGN and Corporate Bonds with investment grade credit ratings. It also offers other bonds issued by the Debt Management Office (DMO) and other money market or fixed income securities that the Fund is permitted to invest in, under the Trust Deed. Asset allocation range:

- FGN Bonds: 35% – 60%

- Corporate Bonds: 0% – 20%

- State Bonds: 0% – 20%

- Short Term Instruments (< 1 year): 10% – 50%

- Cash: 0% – 5%

EQUITIES

Volatility is extremely high, but there is a silver lining. Portfolios are focusing on ‘resilience’, with a preference for quality companies and ‘refraining’ from too much risk. Now is the time for clients to ‘look for opportunities’ in quality businesses that are priced more ‘attractively’ given expected market volatility . There is an attractive reward for investors who can take a long-term view and withstand short-term volatility. Allocation spread according to risk appetite:

HIGH RISK

- Equities: 75% – 100%

- Fixed income securities: 0% – 25%

MODERATE RISK

- Equities: 40% – 75%

- Fixed income securities: 25% – 60%

- Real estate: 0% – 30%

- Cash: 0% – 5%

CONCLUSION: Time for a financial plan

Investing should never be guided by specific moments, but be part of a process over time. Many investors casually accumulate investments for their portfolios without a clearly defined purpose for funds invested. If you don’t have a long-term financial plan, creating one—and sticking to it—is the best action you could take at this time, in order to get clarity on your financial goals.