Instant Diversification

Index-based investing

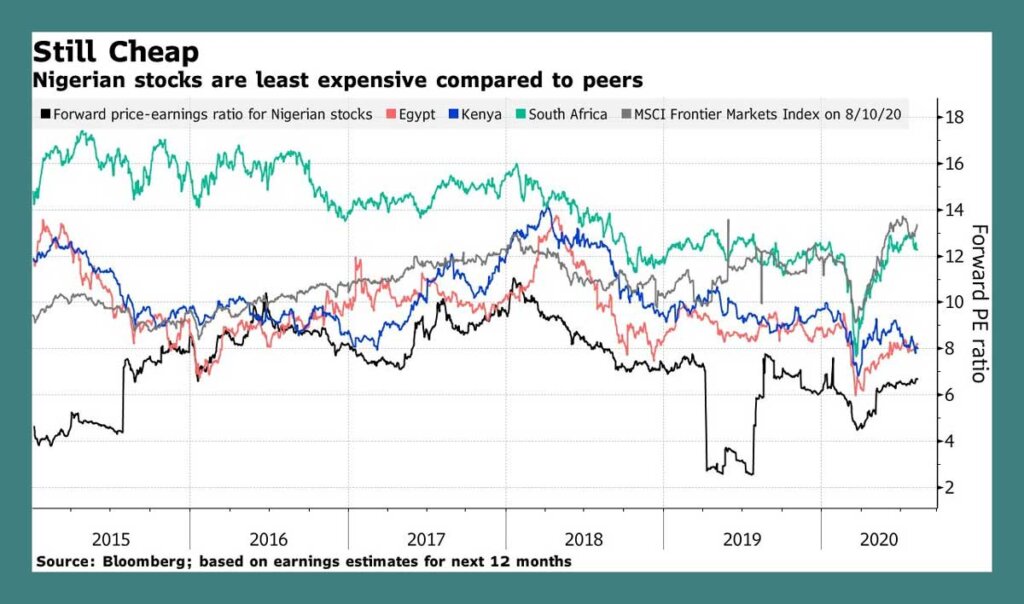

Nigerian stocks are signalling better returns than less-risky local debt markets, where rates are at the lowest in a decade. The NSE ASI for instance has recorded five consecutive weekly gains as at August 21, 2020, with a month to date return of 2.14%.

Yet investors are wary of the opportunity, cautious due to a mix of domestic and external threats and putting off all but the most patient investors.

However, a more pragmatic approach to successfully navigating the markets and generating better returns could lie, not just in the usual sector investing, but in thematic Exchange-Traded Funds (ETFs)

How does sector investing compare to thematic investing, you might ask?

Sector investing offers targeted exposure to companies in specific segments of the economy like health care, energy, or information technology. Similarly, thematic investing typically offers focused exposure but, often cuts across sectors to align with a particular opportunity or objective. For example, although semiconductor producers, mobile phone tower operators, and social media companies are in different sectors, each may be aligned to the theme of disruptive communications

Why invest in ETFs?

The Nigeria Stock Exchange is currently the second largest ETF market in Africa with a market capitalisation of circa N7 billion. From a single ETF tracking the price of Gold in 2011, the market has deepened with 10 ETFs, offering exposure to equities, fixed income, commodities as well as thematic and smart investment solutions. The ETFs market segment is radically reshaping the asset-management industry; gradually overtaking old-fashioned stock pickers, given its ability to replicate passive investing styles.

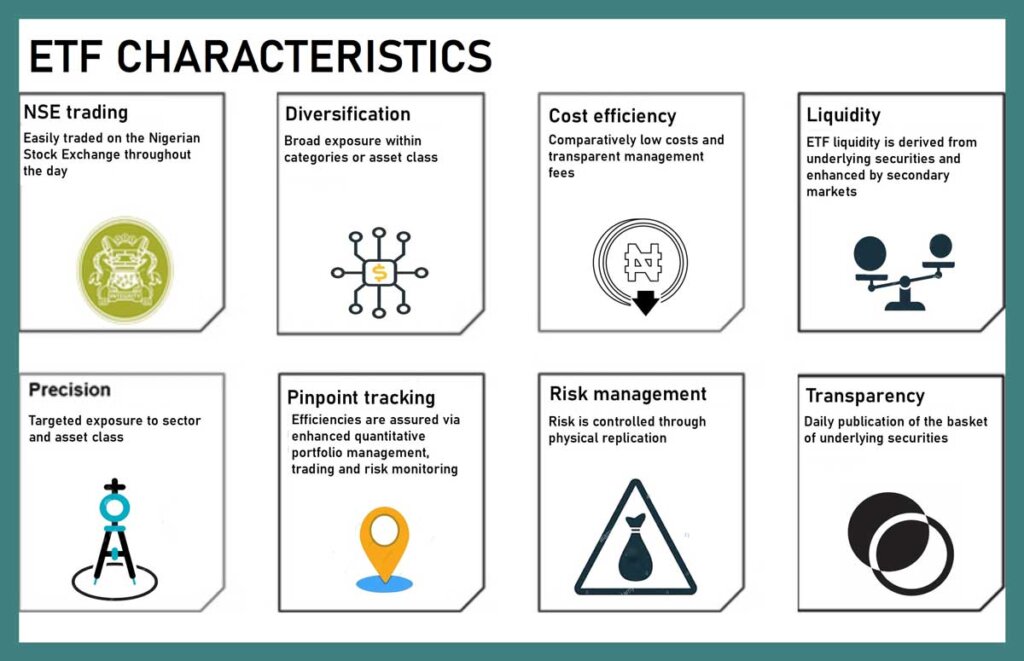

The objective of an ETF would be to provide investors with access to the largest and most liquid public quoted companies, while achieving a net return that reflects the return on the Index. There are many different ways for investors to invest in portfolios but ETFs provide some key characteristics which may appeal to certain investor’s objectives. These include:

Trending Niche9s

Profiting from Thematic Investing

Thematic ETFs are trending globally.

Once considered speculative, advisors and investors are now using thematic ETFs to get niche exposure to emerging industries, or to express a tactical view in a small area of the market.

The difference between an investible theme and a sector ETF is that themes can combine industry types from disparate sectors. For example, a robotics-themed ETF may incorporate industrials and technology. A natural resources ETF might pull from energy and basic materials.

With that criteria:

- Blockchain is a theme, as it is a well-defined opportunity cutting across multiple sectors.

- Agriculture is a nontechnology theme

- Big tech is definitely a huge theme as the Coronavirus outbreak has led technology stocks to outperform. The fourth industrial revolution is in full swing, with disruptive technologies changing the way we live and work. Investors can capitalise on these megatrends by investing in thematic exchange traded funds (ETFs) ranging from the Internet of Things (IoT), cyber security, robotics, artificial intelligence (AI), fintech, future cars/autonomous vehicles, cloud computing, healthcare/genomics and social media.

CONCLUSION

Index funds, at their best, offer a low-cost way for investors to track popular stock and bond market indexes, and in many cases an outperform actively managed mutual funds. The COVID-19 pandemic hasn’t changed common sense investment advice regarding asset allocation, but out of dark times often comes unusual opportunity. There are a number of flourishing industries set to grow from the effects of coronavirus, which makes an investigation of attractive Exchange Traded Funds worth looking into. The main highlight? Thematic ETFs allow you to diversify your risk across many companies, so that major losers are offset by the major winners.