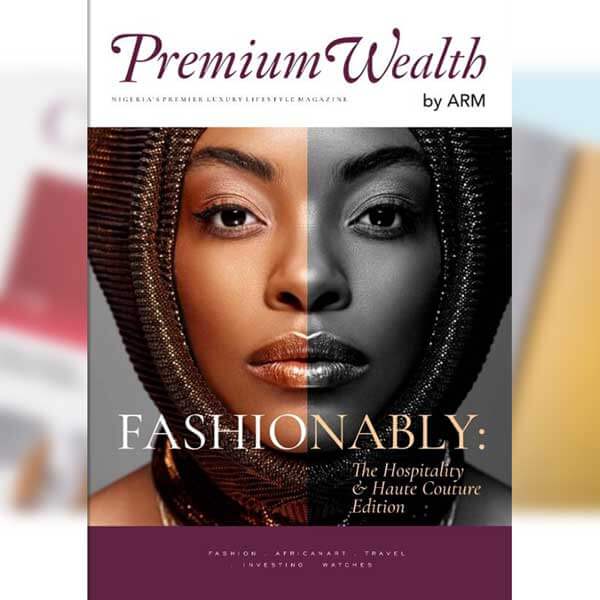

Serge Attukwei Clottey, Fashion icons (2020–21). Image courtesy of Phillips

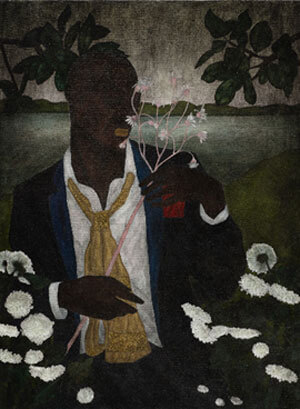

Auction house, Phillips’s October 15 evening sale of 20th-century and contemporary art in London got off to a spectacular start when a barely-dry painting by Ghanian-born artist Serge Attukwei Clottey, Fashion icons (2020–21), which was estimated at £30,000 to £40,000, sky-rocketed to £340,200 ($465,500).

Art is quite unlike any other commodity. It can serve many roles within an investment portfolio, making it an attractive asset. First, it acts as a diversifier, reducing the collector’s risk exposure by spreading investment across different vehicles. When traditional assets like stocks or bonds perform poorly, alternative investments like art tend to hold market value, and serve as a hedge against inflation.

And the message emanating from the experts is clear:

- Regardless of any current fads, the future is bright for any collector drawn to the cultural nourishment that the art world provides;

- Even though collectors buy art for the pleasure of enjoying it rather than with a view of re-selling for gain, they also want to ideally ensure that their emotional investment is a sound financial investment.

Market trends

Young Painters Steal the Show

London, 15 October 2021: Phillips’ 20th Century & Contemporary Art Evening Sale

© Haydon Perrior: Thomas De Cruz Media

The 20th-century and contemporary art sale, hosted by Phillips, attracted bidding from 46 countries, and realised a total of £25.3 million ($34.7 million) – compared to a presale estimate of £16.2 million to £23.3 million ($22 million to $32 million). More remarkable, the auction seemed to have marked a telling shift: Art as a blue-chip investment may be taking a temporary back seat, as buyers chased the latest “red-chip” names.

Red-chip vs Blue-chip

THE BLUES

(Art by the Classics, widely recognised by the art market)

At the Phillips auction, pieces from blue-chip artists managed to find buyers for prices below expectation:

Sigmar Polke’s Negerplastik (1968) selling for a premium-inclusive price of £3.1 million ($4.2 million) – just fitting into a £2 million-to-£3 million expectation.

The Believer (2005), a painting by Marlene Dumas, who is sometimes the subject of heated auction competition, struggled to clear its £1.6 million low estimate. It sold for a hammer price of £1.4 million ($1.6 million).

Likewise, an Andy Warhol silkscreen of Lenin on a bright red background (circa 1986) hammered at £340,00, which was under the low estimate of £400,000.

Following the lukewarm trend, a Richard Prince text painting, My Life as a Weapon (2007), hammered for £360,000 – below the low estimate of £450,000.

THE REDS

(Art by younger, contemporary artists)

The sale saw new records set, not just for Serge Clottey, but also the following stars:

Jadé Fadojutimi Myths of Pleasure (2017) — £1.2 million, or $1.6 million). Estimate £80,000 – 120,000

Tunji Adeniyi-Jones Pattern Makers (2019) (£302,400, or $415,400). Estimate £30,000 – 50,000

Issy Wood (£327,600, or $450,000). Estimate

£100,000 – 150,000

Sanya Kantarovsky No Eyes (2019) — (£390,600, or $536,600). Estimate £100,000 – 150,000

Shara Hughes Night Picket (2017) — (£869,500, or $1.19 million). Estimate £80,000 – 120,000

André Butzer Chips und Pepsi und Medizin

(Das Glück) (2003) — (£403,200, or $533,900). Estimate £70,000 – 90,000

Flora Yukhnovich’s Tondo (2018) £529,200 ($724,000). Estimate £40,000 – 60,000

Cinga Samson. Hliso Street IV (2016) £239,400 ($327,600). Estimate £30,000

.

PHILLIPS AUCTION | OCTOBER 2021 THE RISING STARS

Jadé Fadojutimi

Myths of Pleasure (2017)

Shara Hughes

Night Picket (2017)

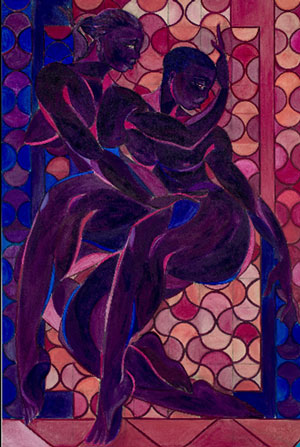

Tunji Adeniyi-Jones

Pattern Makers (2019)

Sanya Kantarovsky

No Eyes (2019)

André Butzer

Chips und Pepsi und Medizin

(Das Glück) (2003)

Flora Yukhnovich

Tondo (2018)

Cinga Samson

Hliso Street IV (2016)

Issy Wood

Eggplant / car interior (2019)

CONCLUSION

Anatomy of Collecting

Art is a passion. It brings emotional fulfilment. Turning your “collector’s vision” into reality requires long-term advisory partnerships built on knowledge and trust. A Wealth Advisor can support current and potential collectors in pursuing their passion, navigating the intricacies of building up a personal art collection, and securing a legacy for future generations.

Download the Report The Art Market 2021, which analyses the global art market by looking at its different segments, such as gallery business, auction houses, changing patterns of global wealth and art collecting, art fairs, online sales, and the economic impact of the art market in general.